HOW TO READ THE COT REPORTS

Understand the COT Reports step by step with our downloadable PDF guide.

How to Read the COT Report – A Complete Guide for Retail Traders

The Commitments of Traders COT Reports are a valuable tool for traders and investors to understand market sentiment and positioning. The CFTC releases reports detailing the open interest and trading activity of different market participants, including commercial traders and non-commercial traders such as hedge funds and large speculators. As a result, retail traders like you and me can use this information — in conjunction with Technical Analysis (TA) — to make more informed trading decisions..

Interpreting the data can be a complex task, especially for beginners.

That’s why I have created this PDF guide that will teach you how to read the COT Reports with ease. This guide is perfect for traders who are new to the market or looking to expand their knowledge of market analysis.

Perfect for Beginners

This PDF guide is divided into three parts:

-

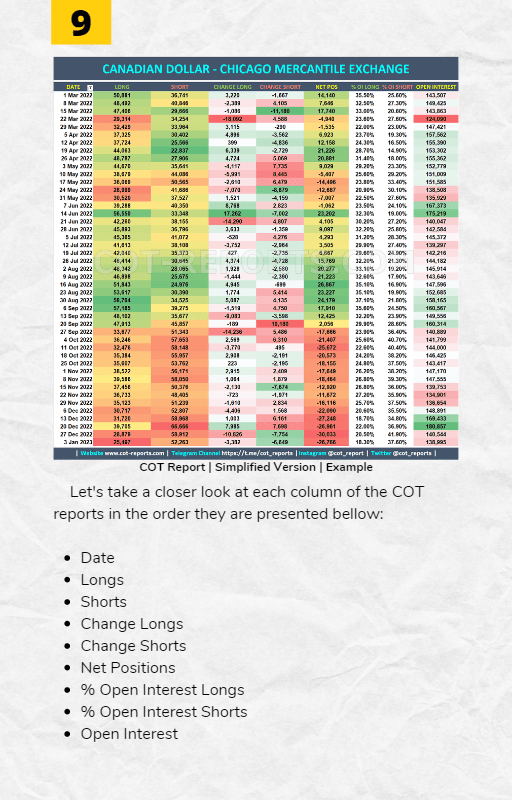

Firstly, I cover the basics of COT reports by explaining where the data comes from, how it is provided, and what it is used for. Additionally, I also provide an in-depth explanation of the different columns in the COT reports and how to interpret them.

-

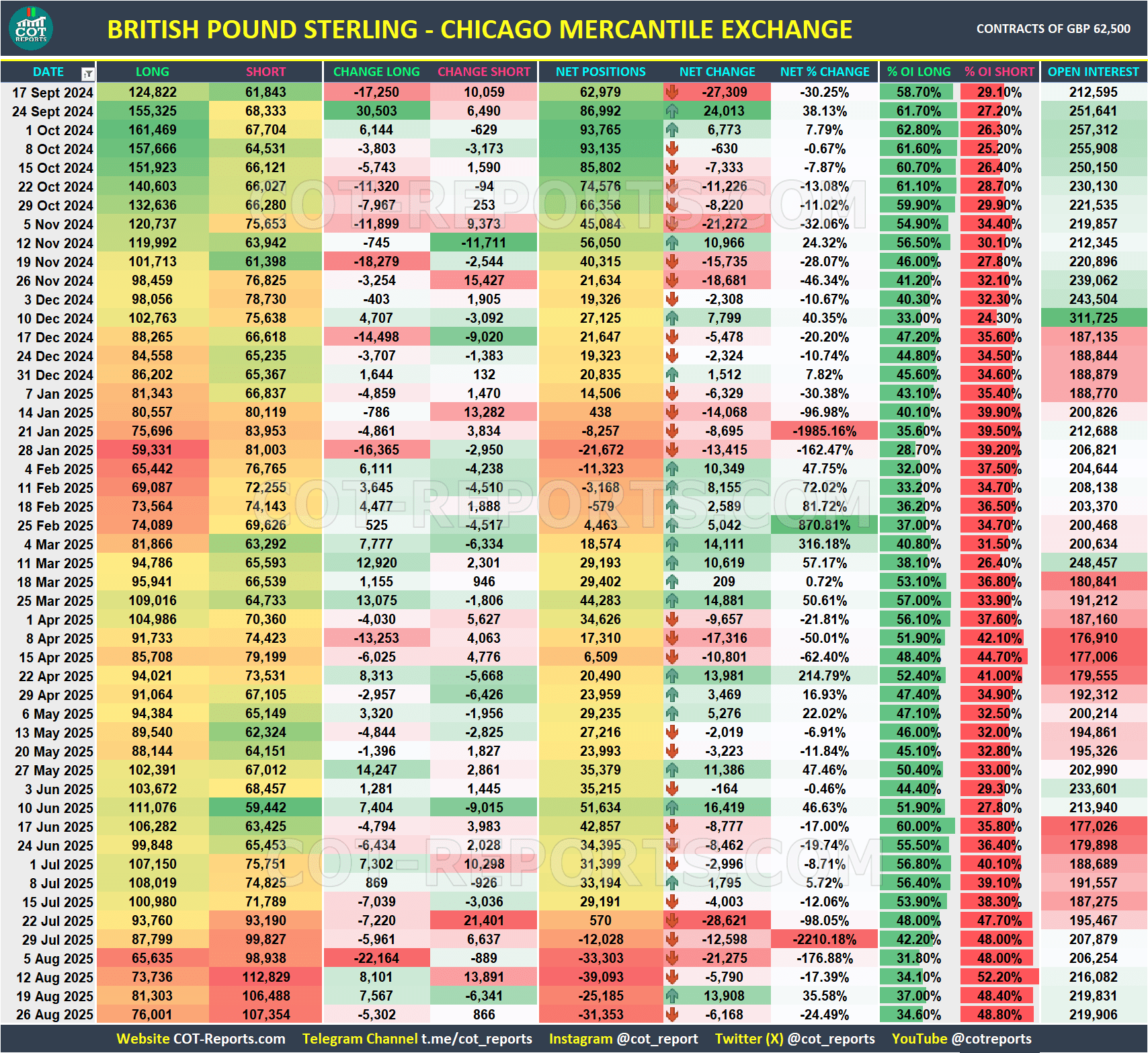

Secondly, I dive deeper into the COT reports by introducing my custom version of the COT reports, and furthermore, how to use the colors in them to gain more insight.

-

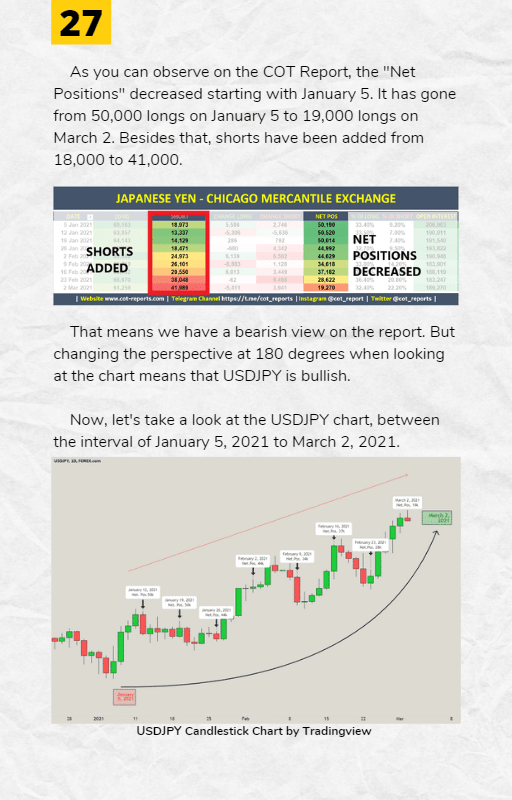

Lastly, I show you how to analyze the relationship between a currency’s COT report and candlestick chart, in order to give you a complete picture of market sentiment and positioning.

Ready to master COT Reports analysis? Get instant access to the complete PDF guide now.

Download PDF Guide NowPREVIEW OF THE PDF GUIDE “HOW TO READ THE COT REPORTS”

DISCOVER THE MARKET INSIGHTS OF SMART MONEY

THESE REPORTS ARE A VALUABLE TOOL FOR UNDERSTANDING MARKET SENTIMENT AND POSITIONING. ADDITIONALLY, YOU CAN USE THE COT REPORTS TO IDENTIFY POTENTIAL TREND REVERSALS.

Advantages of Using the Commitments of Traders COT Reports

For example, if hedge funds have a large net short position in a particular market, this may indicate that they are positioning themselves for a market downturn.

You can use the COT reports to identify potential trend reversals. For example, when non-commercial traders have a large net short position, it may indicate that the market is oversold and due for a rebound.

The COT reports can be used in conjunction with Technical Analysis (TA) to get a better view of the market. Additionally, it can help technical trader to identify the large market player’s position and make a better trading decision.

I am sharing the COT reports for free. As a result, traders and investors can access this valuable information without having to pay for it.

Overall, traders find the COT reports to be a valuable tool. They use the COT reports to gain insight into market sentiment, positioning, and potential trend reversals. Additionally, traders often use the reports in conjunction with other market analysis techniques, such as Technical Analysis, to make more informed decisions.

Introducing my PDF guide, designed to explain each high impact news event in the Forex market. If you’re a novice trader seeking to understand market dynamics when news events are released, this guide is your go-to resource for mastering the major economic releases. Rest assured, I’ve conducted extensive research to present the information in a well-structured format, saving you time and ensuring clarity in your understanding of these events.